Confidence Crisis & Coffee Inflation

- David Halseth

- Oct 5, 2025

- 2 min read

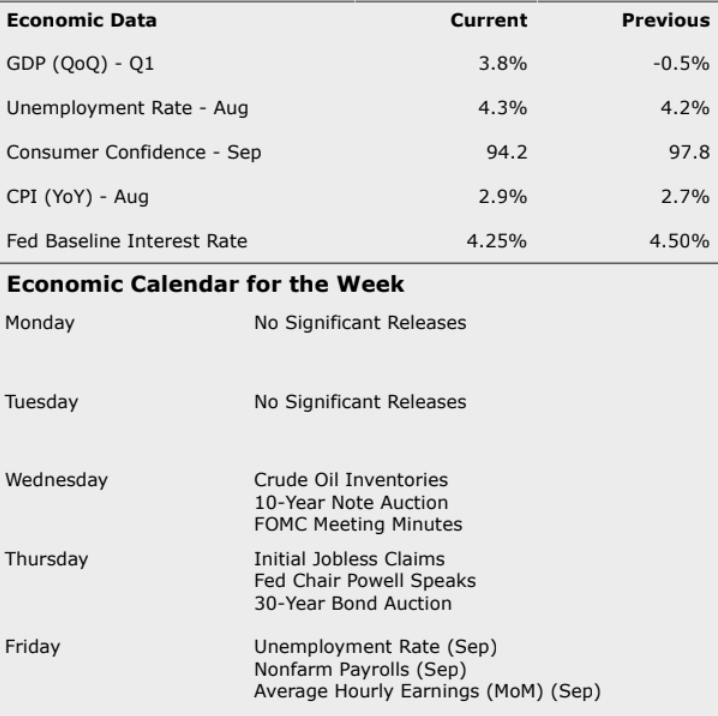

For the week ended 10/04/2025.

Welcome to October. Before you take a sip of that increasingly expensive Java, let’s talk confidence – consumer confidence, that is. While admittedly a volatile metric, it’s still one of the better gauges of how Americans feel about the economy. And right now, the answer is: not great.

The Conference Board’s Consumer Confidence Index slipped to 94.2 in September from a revised 97.8 in August, its lowest level in over a year and the ninth straight monthly decline. Economists were expecting 96, so it’s safe to say the mood soured faster than milk left on the porch. The decline was driven largely by growing anxiety over the labor market, with fewer people saying jobs are “plentiful” and more saying they’re “hard to get.”

Supporting that sentiment, ADP reported a 32,000-job loss in the private sector last month. The leisure and hospitality industry – usually a bright spot – shed 19,000 jobs, while education and health services managed to add 33,000. Most of the weakness came from small employers, those with fewer than 50 employees. And because the BLS jobs report is delayed (apparently the government is too busy arguing about whether to keep the lights on), this ADP data is getting extra attention.

Yet, markets took it all in stride. Stocks rose 1.1% on the week, and bonds gained 50 basis points. Why? The A.I. narrative continues to captivate investors. For example, BlackRock’s consortium is reportedly close to a $20 billion data-center acquisition, and startup Groq, valued at $6.9 billion, is planning to expand its own footprint.

And yes, your morning cup isn’t immune to inflation either, coffee prices are up roughly 22% year-over-year. Between tariffs and crop disruptions, it’s becoming a luxury item. Unfortunately, Kansas still isn’t great for coffee farming.

So, drink up – and maybe skip the extra shot this week.

Interesting data point of the week.

Source: Visual Capitalist

Comments