Disco, Debt, and the CPI Hustle

- David Halseth

- Aug 10, 2025

- 2 min read

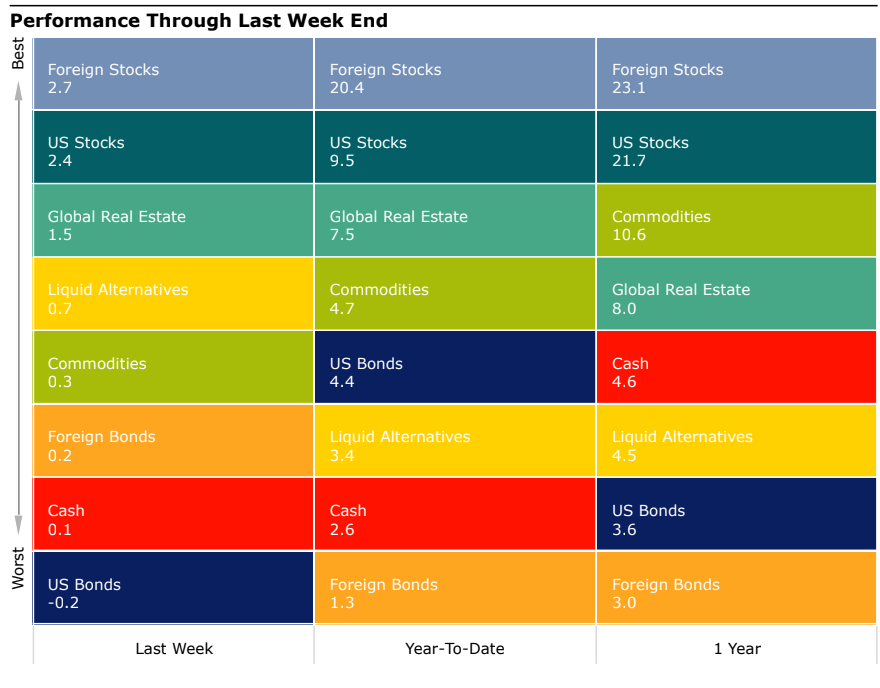

For the week ended 8/9/2025.

It was the 1970s: a great time to be alive, KC and the Sunshine Band on the radio, Star Wars in theaters, civil rights momentum in the air, and some truly questionable fashion choices on the streets. Of course, it was also the height of the Vietnam War, Watergate, and the not-so-groovy scourge of stagflation.

For the uninitiated, stagflation is the economic equivalent of being stuck in traffic while your gas tank is leaking. In textbook terms, it’s when prices are rising quickly (sound familiar?) even as employment growth slows and the economy taps the brakes (sound familiar again?).

Case in point: July’s ISM Services Prices Paid index suggests inflationary pressure in the service sector is on the rise – a reading that often leads the CPI by three to six months. Meanwhile, job growth is cooling, and the unemployment rate seems to be structurally creeping upward.

Why? Theories abound, but most serious conversations point to our old friend Mr. Tariff, the uncertainty he drags along, massive federal debt, and the steady weakening of the almighty greenback.

So, what’s the Fed to do? Focus on inflation and hike rates to slay the beast before it gets bigger, Alien-style, when it’s still the size of a salamander? Or follow the Executive’s drumbeat, worry about growth and jobs, and cut rates?

Markets are clearly pricing in cuts, but ignoring the risk of resurgent inflation is a dangerous game. Bottom line: the dark shadow of stagflation may be inching closer, and it’s worth keeping an eye out.

Speaking of eyes, Tuesday brings the latest CPI release. May’s reading was 2.4%, June’s ticked up to 2.7%, and expectations for July sit at 2.8%. Anyone notice a trend?

And with that, may your Monday be productive, your coffee strong, and your countdown to football season short. The only question is, which pro league will you be tuning in for: NFL or NCAA?

Interesting data point of the week.

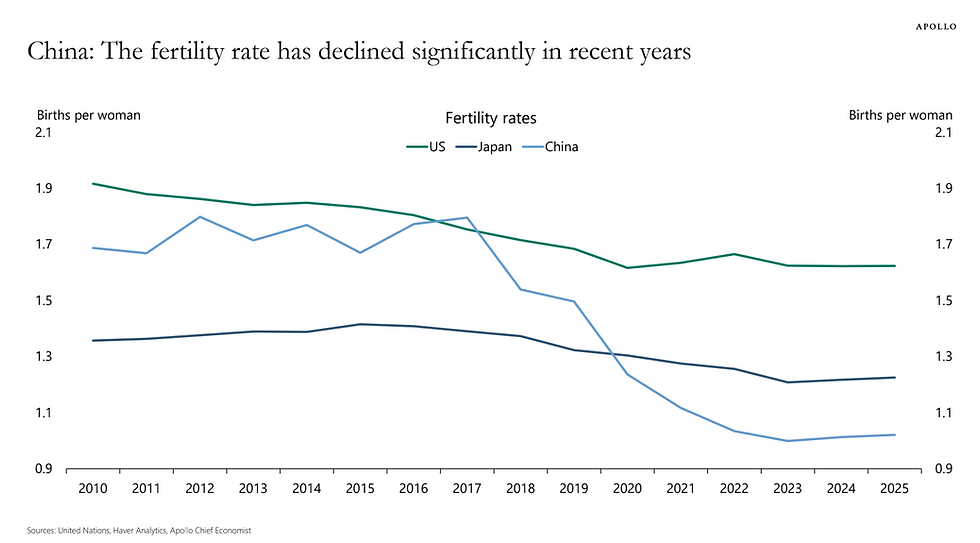

I’ve mentioned before the serious demographic storm brewing in China, but it bears repeating, this isn’t just a challenge; it’s existential. Still think that’s an exaggeration? Consider these two charts: the working-age population is projected to shrink by 29% over the next 25 years, and by a staggering 60% over the following 50. Meanwhile, the birthrate has dropped below 1 (and in case you missed that day in demography class, you need just over 2 to keep a population stable – assuming no immigration).

If you can find me a civilization in the history of mankind that’s held together under those conditions, I’ll personally eat this week’s CPI report. And I hate fiber.

Source: Apollo Chief Economist

Comments