Inflation Déjà Brew

- David Halseth

- Oct 26, 2025

- 2 min read

For the week ended 10/25/2025.

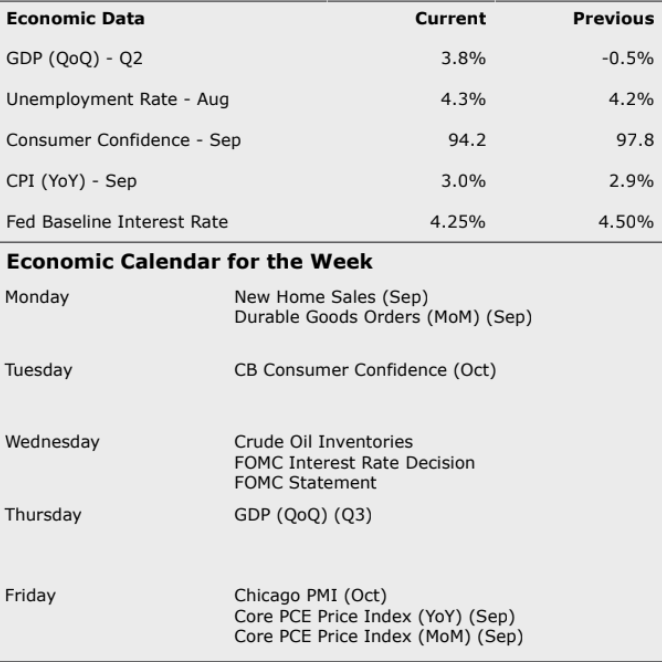

Well, it took a bit longer than usual, but the Labor Department finally produced September’s inflation report – and it came in at 3.0%. That’s higher than August’s rate and ties January for the high-water mark of 2025. Cue the financial media’s collective sigh of “it could’ve been worse,” as the reading came in just below economist expectations, fueling chatter for yet another rate cut this week – and possibly one more before year-end.

But let’s be clear: inflation remains sticky. Retailers continue to pass along many tariff-related costs, keeping prices elevated for everything from apparel and sporting goods to that essential morning fuel – coffee. (Yes, caffeine now costs around 40% more to stay alert about inflation.) As an aside, the U.S. reportedly collected about $30 billion in tariff revenue last month, of course, much of that never hit consumers thanks to the usual maze of exemptions and creative accounting.

Markets clearly liked what they heard, with domestic equities jumping 1.9% last week to lead all asset classes. Commodities followed at +1.7% — a polite reminder that higher gasoline prices are likely coming soon — while foreign stocks gained 1.5%. Even the long-suffering bond market managed a 20-basis-point lift, pushing year-to-date returns to 7.4% as investors continue to bet on the sugar high of rate cuts and middling growth.

Speaking of growth, Thursday brings the initial release of third-quarter GDP, expected around 3.0%. Not bad if it holds up. But the day before, Jerome and his merry band will decide the next baseline rate — with most betting on a 25-bps trim. So yes, despite inflation still sitting roughly a third above the Fed’s “comfort zone,” they’re cutting again. Washington’s current priority? Job creation, inflation be damned.

And with that, take your newfound macro knowledge, pair it with a good cup of coffee, and charge into the week. Happy Monday.

Interesting data point of the week.

Comments