Shaky Growth, Surly Dissent, and a Cup of Calm

- David Halseth

- Aug 3, 2025

- 2 min read

For the week ended 8/2/2025.

Much going on in economic land, so refill your mug and buckle in.

First, the bright spot: consumer confidence ticked up in July. Apparently, someone out there is still feeling good. Maybe it’s the same folks who celebrated the second-quarter GDP figure, which jumped to 3.0% after the prior quarter’s -0.5%. That puts first-half annualized growth at a modest 1.2%. But before you toast to recovery, let’s remember both quarters were distorted by trade whiplash. Tariffs giveth and taketh away – and mostly, they giveth uncertainty.

Speaking of uncertainty, the Fed decided to hold baseline rates steady last week, but not without drama. For the first time since 1993, multiple board governors dissented. Notably, they were recent Trump appointees, each allegedly auditioning for Powell’s chair. If this were reality TV, we’d be in the rose ceremony phase.

Meanwhile, the jobs picture dimmed. Only 73,000 nonfarm jobs were created in July, and June’s already anemic gain was revised downward to just 14,000. That’s not just a miss – that’s a faceplant. Unemployment nudged up to 4.2%, a subtle reminder that labor markets, like avocado toast, don’t always live up to the hype.

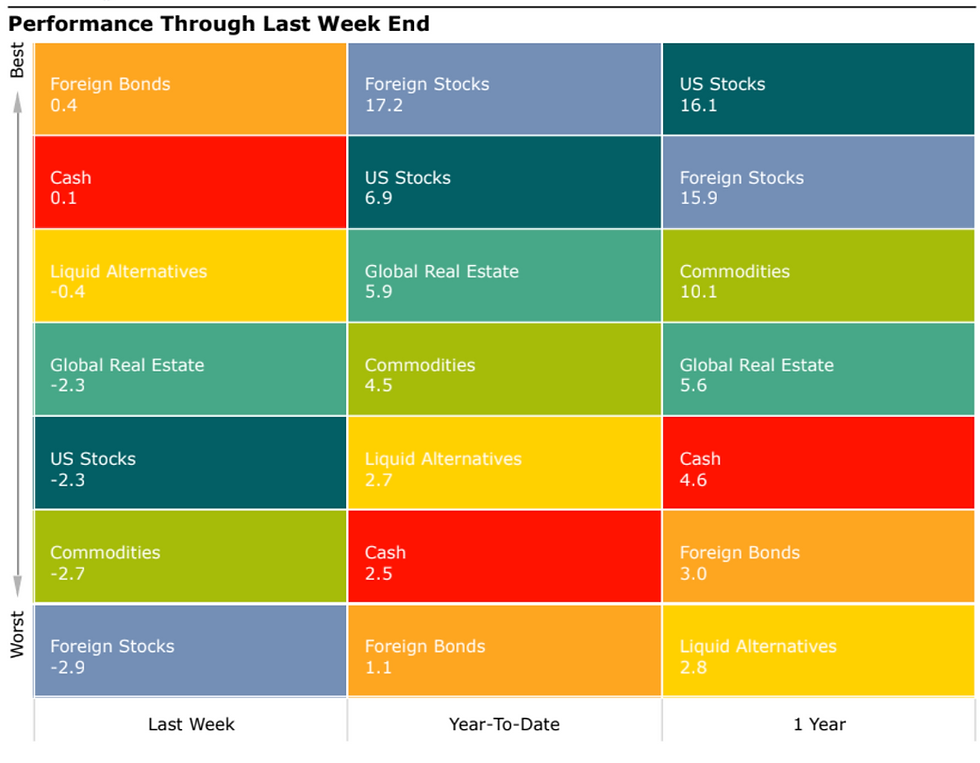

Naturally, the markets didn’t take this lying down. The S&P 500 fell 2.3% last week, with global real estate and international stocks sliding in lockstep. But fixed-income reminded us why we keep it around: domestic bonds rose a respectable 95 basis points, and foreign bonds followed with a 40 bp gain. Boring? Yes. Useful? Also yes.

Looking ahead, non-manufacturing PMI hits Tuesday, and Treasury auctions on Wednesday and Thursday could offer a sneak peek into investor appetite amid ballooning federal debt.

Until then, may your week be filled with clarity, your coffee with caffeine, and your headlines with fewer dissents. Or at least more entertaining ones.

Good morning.

Interesting data point of the week.

Comments