The Data Doesn’t Care What You Want

- David Halseth

- Jul 20, 2025

- 2 min read

For the week ended 7/19/2025.

It’s becoming increasingly difficult to fire someone, especially in the court of public opinion, when you’re calling for a policy that flat-out ignores the data. And this isn’t obscure, backroom-only data; it’s plastered across every daily feed, stream, and periodical for anyone who can read.

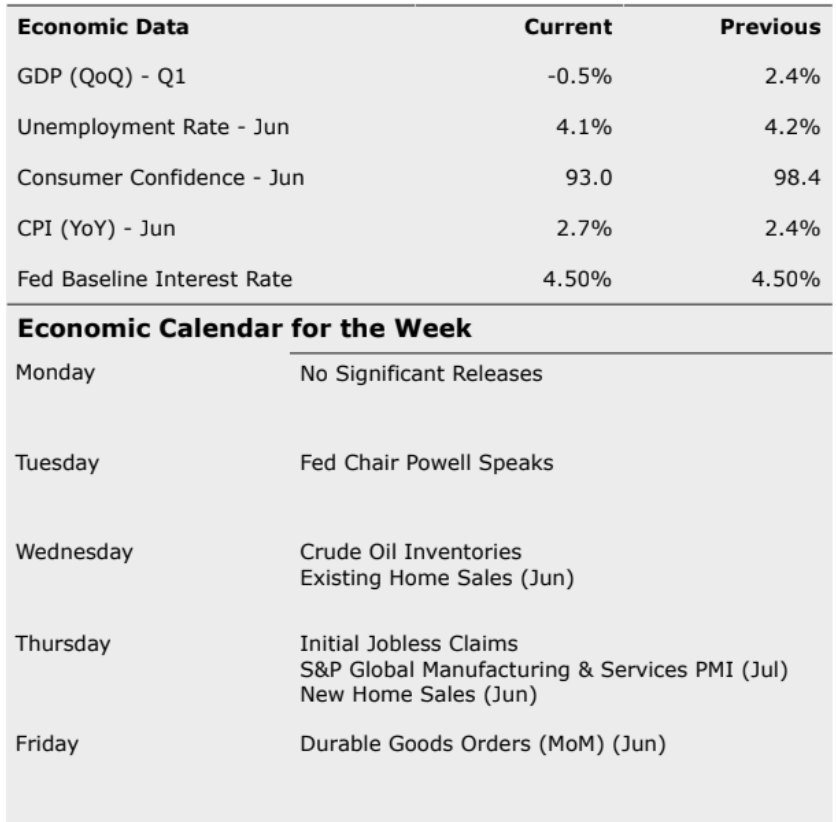

Yes, I’m talking about the ongoing “fire Powell” sideshow, fueled by demands for lower baseline interest rates. But here’s the inconvenient truth: the latest inflation checkpoint shows our old nemesis picking up steam as headline inflation jumped from a comfy 2.4% to 2.7%, while Core CPI remains stubbornly high at 2.9%. And before you blame oil, know this: energy prices are still oddly soft.

Naturally, discretionary goods – furniture, toys, clothing, and (gasp) coffee – took the biggest hit, likely reflecting tariff pass-throughs. June clocked in as the largest monthly price spike of 2025 so far. But perspective matters: while this inflation bump isn’t catastrophic, it’s certainly not a reason to slash rates.

So, does Powell really deserve a pink slip for holding the line? You decide, but the data sure seems to have his back.

On to the markets: last week was best described as meh. Commodities eked out a 1.3% gain, domestic equities climbed a modest 60 bps, and foreign stocks added 40 bps. Everything else? Pretty much zero movement as domestic bonds, liquid alts, and global real estate flatlined, while cash and foreign bonds barely scratched out a gain under 10 bps.

Looking ahead: Powell grabs the mic on Tuesday, and we’ll digest new home sales and PMI reports later in the week. Expect markets to key off any hint of what’s next from the Fed – even a sideways glance could move yields.

In the meantime, keep your morning brew hot (despite rising prices) and your evening libation cold.

Welcome to Monday.

Interesting data point of the week.

Comments